Digital Disruption: Sports Authority’s Downfall – History Repeats Itself

Well known sports retailer was not the first to fall, but they are the latest. We take a look at what happened.

Well known sports retailer was not the first to fall, but they are the latest. We take a look at what happened.

For decades, retailers have enjoyed healthy competition amongst themselves – industry leaders and “not-far-behind” rivals have pushed each other to excel. With the introduction of digital business and online giants like Amazon, who could gain market share with each consumer’s press of a key, close second suddenly became a dangerous place for a brick & mortar retailer. In 2008, Linens N’ Things, unable to surpass Bed Bath & Beyond, closed its stores. The next year, Circuit City followed suit as Best Buy dominated the #1 spot. In 2011, 2 years after Barnes & Nobles launched their Nook platform, Borders Bookstore who still hadn’t ventured into the digital world, closed its doors as well. Now in 2016, Sports Authority has suffered the same fate, as Dick’s Sporting Goods (DSG) takes the top spot in the sporting goods industry with their truly omni-channel customer experience. In all these cases, the retailer who maintained dominance was able to adjust to evolving customer behavior, leveraging digital business to enhance the brick & mortar experience. This article will discuss 2 key concepts that led to the downfall of Sports Authority:

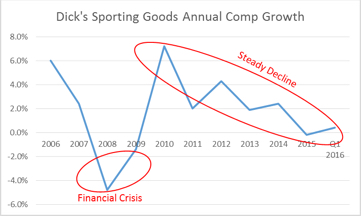

As ecommerce and digital business has grown, companies across all industries – both retail and B2B services – have had to adapt and change their business models to sell their products & services. In the retail world, a significant cause of this shift has been customer behavior – as more and more customers have migrated to an online path-to-purchase, the efficiency of big box stores (and their ability to drive significant sales growth) has declined for a prolonged period. Needless to say, Sports Authority and Dick’s Sporting Goods are no exception. Since 2006, Sports Authority has been held by a private equity firm mired in debt, a condition that was not helped by flat revenues in 2013 and 2014. By February 2016, Sports Authority’s problematic situation had only worsened resulting in the $343 million of subordinated debt leading to their subsequent Chapter 11 filing. This has meant that Sports Authority has been severely hampered in their ability to invest in digital business for almost a decade. Desire and business sense aside, Sports Authority lacked the necessary resources to enact a significant change to the current customer engagement and sales model. Their inability to invest in the future and the “new” phenomenon of digital business prevented Sports Authority’s from stimulating a shift in sales growth to halt the decline in Same Store Sales (comp sales). Similarly, Dick’s Sporting Goods has also seen a decline in comp growth over the past 6 years (see Figure 1).

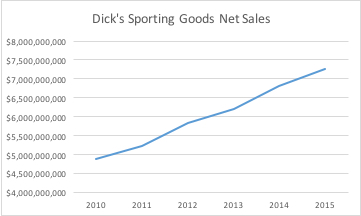

The declining comp growth in Figure 1 suggests that Dick’s Sporting Goods was experiencing the same difficulties as Sports Authority – declining in-store sales across the Sporting Goods industry. Despite this decline, comp sales growth remains positive – an unusual trait for a brick & mortar retailer in this industry climate. Dick’s Sporting Goods invested into the omni-channel experience to enable continued growth; for a retailer, the cheapest investments are those made to the stores themselves. Combined with their digital business, Dick’s Sporting Goods enhanced their brick & mortar customer experience by choosing premium locations for new doors, renovations and upgrades to stores and adopting the store-in-a-store layout. Unlike Sports Authority, where a customer simply wanders the sections, aisle by aisle to find a product, Dick’s offers customers an interactive experience with an activity. Brand loyal shoppers can quickly identify and interact with branded kiosk-like sections of the store; for example, the Nike or Under Armour sections commonly found in Dick’s Sporting Goods stores. The biggest innovation for Dick’s Sporting Goods came in the form of enhanced customer engagement – their “golf shop” within a store not only facilitated the transactional experience of browsing, trying out and ultimately purchasing a product but also allowed for a customer to engage with the Dick’s brand. With certified golf professionals on the floor, golfers could take lessons, leverage swing analysis technologies and interact with the Dick’s brand without the goal of making a purchase. This customer engagement based experience builds trust and loyalty with the modern consumer and brings Dick’s Sporting Goods to the front of a shopper’s mind facilitating positive Net Sales Growth (see Figure 2).

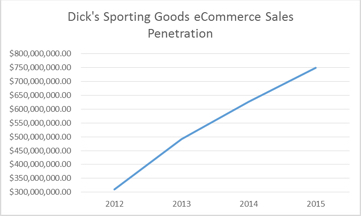

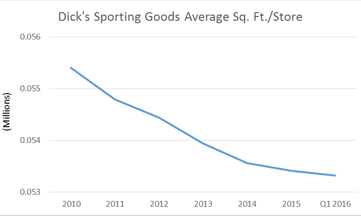

Clearly, Dick’s Sporting Goods has had the ability to invest in modifying their strategies for customer engagement and sales. However, any company that has the ability to invest, still needs to invest wisely to reap the rewards. Dick’s Sporting Goods was able to identify the importance of digital business and eCommerce. In the past 6 years, their leadership made a conscious decision to shift focus from in-store sales driven primarily by large square footage stores to increasing their ability to connect with a consumer via the omni-channel experience and online sales (see Figures 3 & 4)

Figures 3 & 4 clearly show that over the same period of time, online sales penetration for Dick’s Sporting Goods has trended positively while average square footage per store has been decreasing. As part of their conscious effort to effect change, in line with the disruption caused by digital business & eCommerce, Dick’s Sporting Goods approached the challenge from two fronts – invest in increasing online sales and reducing cost by reducing the average size of stores. This conscious decrease in average store size allowed Dick’s Sporting Goods to make the necessary investments into in-store customer engagement with the saved capital. Their omni-channel innovation also extended into loyalty programs, credit card programs with cash rewards incentives and integration into fitness & wellness programs like FitBit and the MapMyFitness suite. With all these programs integrated to the website as well as the Dick’s Sporting Goods app, Dick’s Sporting Goods was able to consistently engage with customers outside the transaction experience. Additionally, in 2014, Dick’s Sporting Goods parted ways with their long-time eCommerce partner GSI Commerce and brought their online business in-house. This allowed them to take full control of their digital business enabling their online sales channels to augment their in-store engagement. With functionalities such as in-store pick up, ship from store and vendor drop ships, Dick’s Sporting Goods has been able to broaden their digital engagement with customers and establish brand loyalty. With online giant Amazon always lurking, retailers’ ability to constantly engage with a customer, regardless of channel, is vital to maintaining competitive market share.

This two-pronged approach to expanding customer engagement and building a customer-centric brand is central to Dick’s Sporting Goods’ continued rise. It has recently been revealed that Dick’s Sporting Goods has won the auction of Sports Authority’s intellectual property. The $15 million bid gives Dick’s Sporting Goods ownership of sportsauthority.com, their 28.5 million member loyalty program and a list of 114 million customer files. By gaining control of the loyalty base and customer data of what was the #2 spot in the industry, Dick’s Sporting Goods has grabbed a low-cost, high-yield opportunity to almost instantly expand their customer base. Combined with control of Sports Authority’s digital footprint, Dick’s Sporting Goods enhanced ability to engage with customer across digital channels puts them in good stead to rapidly expand their ecommerce penetration. Dick’s Sporting Goods has also spent another $8 million to acquire the leases for 31 Sports Authority stores. With roughly 80% of Dick’s Sporting Goods’ ecommerce sales being generated within brick & mortar store trade areas, this increase in doors can lead to a two-fold increase in sales as Dick’s Sporting Goods adopts Sports Authority’s customers and generates new online traffic in the vicinity of these new locations.

So, returning to the original questions posed at the outset of this article, where did Sports Authority possibly fall short? And how did Dick’s Sporting Goods manage to stay afloat? Dick’s Sporting Goods stayed afloat by investing heavily in omni-channel customer engagement and is now poised to become the outright leader in the industry. By comparison, Sports Authority missed opportunities to capitalize on the digital business shift due to an inability to make the necessary investments and transform the business. Combine this with flat revenues and increasing debt, Sports Authority found themselves with no way out of a declining situation. For all of these companies, from Linens N’ Things to Circuit City, Borders to Sports Authority, building a customer-centric brand proved to be the impenetrable barrier to the future. Whether online or in-store, these brands could not engage with customers, build brand loyalty and deliver against customer expectations while their now industry leading competitors were able to do so earlier and with greater efficacy.